The memory market has moved into a tighter, more managed environment. This is not a typical cycle in which pricing falls during excess supply and rises when demand returns. The current phase is being shaped by two durable forces: suppliers are actively steering capacity toward higher-value products, and demand is being reallocated toward AI infrastructure that is more memory-intensive than prior compute generations.

This dynamic was underscored at CES, where NVIDIA CEO Jensen Huang1 emphasized that the limiting factor for AI systems is no longer raw compute but memory. As models scale, he highlighted that memory bandwidth, memory capacity, and data movement are becoming fundamental constraints on performance and efficiency.

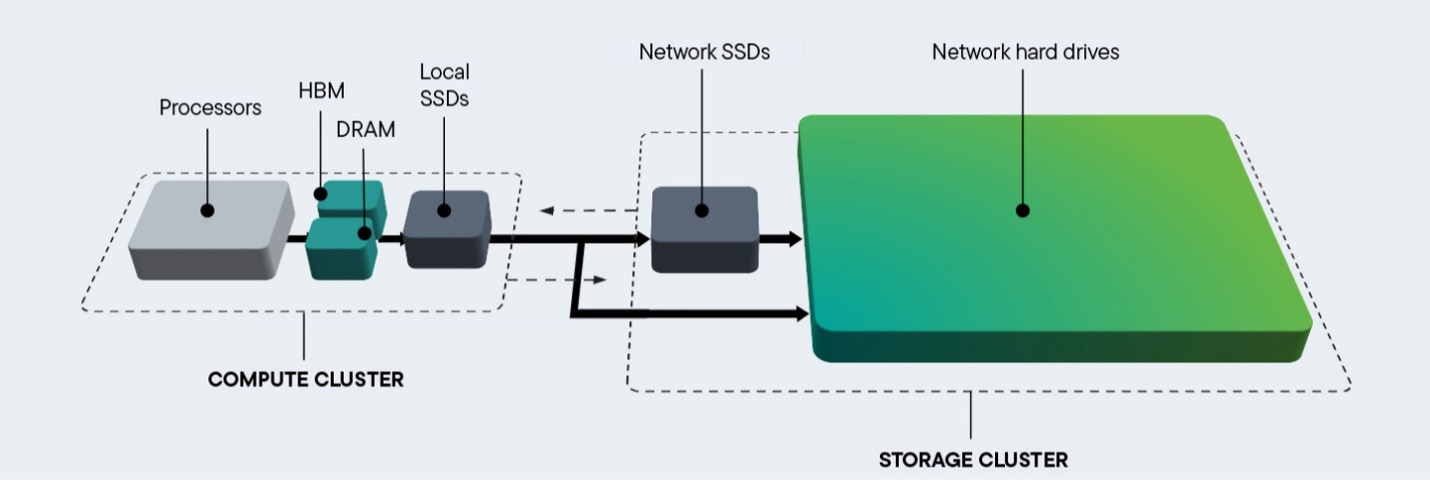

[caption id="attachment_13247" align="alignnone" width="1430"]

Figure: AI data interacts with a variety of storage and memory devices (source: Seagate)

Figure: AI data interacts with a variety of storage and memory devices (source: Seagate)[/caption]

In practical terms, more memory is required to be closer to compute, and it must move faster and at scale. That reality places sustained pressure on the memory ecosystem well beyond accelerators alone. When those resources become critical to uptime and schedule, purchasing behavior changes. Customers commit earlier, hold more buffer inventory for hard-to-replace parts, and prioritize continuity over spot optimization.

Why is capacity constrained?

Capacity constraints today are less about a single chokepoint and more about product mix and transition timing.

For DRAM, suppliers are concentrating investment and output on products tied to long-term growth and profitability.

Two areas stand out: DDR5 for modern platforms and HBM for accelerators.

As capacity and engineering focus shift toward these segments, legacy DRAM receives less support, especially in DDR4. Even where DDR4 demand remains meaningful due to the installed base and longer qualification cycles, memory suppliers have clear incentives to reduce exposure to low-margin legacy parts and move the market forward. As a result, DDR4 is increasingly characterized by constrained availability, less pricing elasticity, and a higher risk of allocation.

For NAND, the conversation is more nuanced.

NAND wafer supply matters, but finished product availability often depends on additional components and manufacturing steps. Enterprise SSDs, for example, rely on controllers, substrates, PCBs, power loss protection components, and, in many cases, drive DRAM. If any of these elements become constrained, finished drive output tightens even if NAND supply is improving. Buyers sometimes underestimate this, assuming that a better NAND supply picture automatically translates to abundant SSD availability. Constraints can migrate across the bill of materials.

What memory makers are doing

Rather than expanding output aggressively at the first sign of recovery, memory suppliers are focusing on profitability, product mix, and long-term positioning. In practical terms, that means:

- Prioritizing higher value DRAM segments, particularly DDR5 and HBM.

- Exiting or de-emphasizing lower margin businesses to focus on higher value, AI-driven memory products.

- Using allocation frameworks that favor customers with credible forecasts and committed demand.

- Managing capital spending to avoid creating the kind of oversupply that would rapidly reset pricing.

For customers, this matters because it changes the rules of engagement. In a more managed market, availability can depend as much on planning and commitments as it does on willingness to pay in the moment.

Inventory and why it is not a reliable shock absorber

Inventory conditions across the ecosystem have shifted. In recent years, many channels built inventory buffers during periods of uncertainty. As the market tightened and product transitions accelerated, those buffers have been drawn down. What remains is often unevenly distributed.

Some inventory is held by large OEMs, hyperscalers, or major module houses. Some are committed to specific platforms or customers. Some do not match current qualification requirements. The implication is that inventory can exist in the system while buyers still experience scarcity for the parts that matter to their builds.

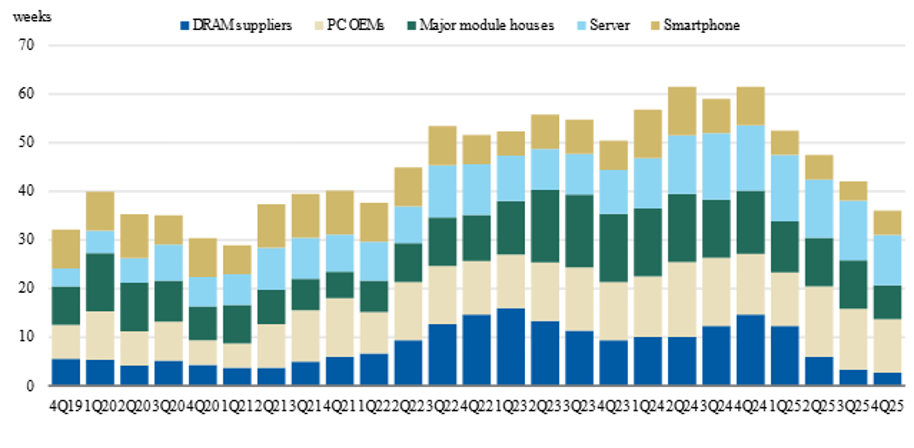

[caption id="attachment_13248" align="alignnone" width="914"]

Figure: DRAM Inventory Levels (source: Morgan Stanley Research and TrendForce, Jan 2026)

Figure: DRAM Inventory Levels (source: Morgan Stanley Research and TrendForce, Jan 2026)[/caption]

This is particularly relevant for DDR4-dependent programs and for qualified enterprise storage configurations. Where substitution is difficult, buyers tend to secure coverage earlier and hold it longer. That behavior reduces the availability of flexible supply and amplifies short-term disruptions.

Implications for pricing and availability

The market implication is straightforward: the greatest pricing pressure and availability risk sit at the intersection of two factors, constrained supply and limited alternative options.

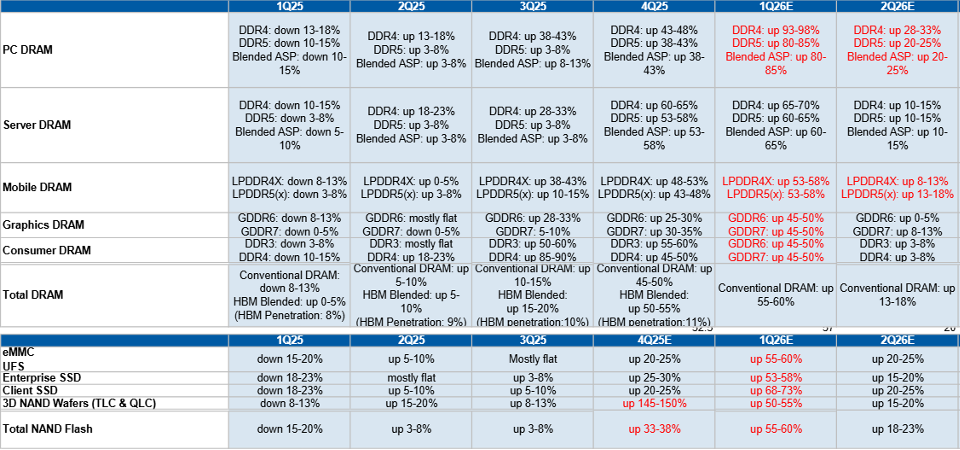

For DRAM, legacy products are exposed because supply is being deprioritized while demand persists. DDR4 is the clearest example. As production attention shifts to DDR5 and HBM, DDR4 tightness can emerge quickly, and pricing can move sharply because buyers have fewer near-term alternatives. In contrast, DDR5 continues to benefit from strong platform momentum, but pricing is still influenced by capacity being pulled toward HBM and by the pace of server buildouts.

For NAND and SSDs, availability and pricing are increasingly shaped by enterprise demand and by the full component stack behind finished drives. When enterprise storage demand is strong, upstream NAND pricing can firm, but the more immediate pain points for many buyers are finished drive allocation, extended lead times, and the need to secure the right configuration rather than any SSD at any price.

Overall, the market is signaling a period when volatility is more likely to show up as allocation events and step changes in quotes, not just gradual movement. Buyers should expect continued tightness in parts tied to AI infrastructure and in legacy products that suppliers are intentionally steering away from.

[caption id="attachment_13249" align="alignnone" width="960"]

Figure: Memory and Storage Pricing Trends and Forecast for Q1’26 and Q2’26. Source: Morgan Stanley Research and TrendForce)

Figure: Memory and Storage Pricing Trends and Forecast for Q1’26 and Q2’26. Source: Morgan Stanley Research and TrendForce)[/caption]

Where to go from here: Arrow’s recommendations

The most effective response is to treat memory and storage as schedule-critical inputs, not as late-stage commodities. The following actions consistently reduce risk:

Build a DDR4 continuity plan.

If you have platforms that require DDR4, define the coverage horizon now. Identify last-time-buy requirements, validate alternate sources where feasible, and avoid waiting until pricing dislocates or allocations tighten further. Where possible, align future designs and refresh cycles to DDR5 adoption so you are not anchored to a shrinking supply base.

Use forecasting as a supply tool.

In a managed market, credible demand visibility improves allocation outcomes. Share forecasts early, refresh them routinely, and align them to production schedules. Buyers who provide clean visibility tend to see better continuity than those who rely on ad hoc ordering.

Consider longer-term commitments for constrained items.

For parts that are hard to substitute or that sit in the most constrained segments, longer term agreements can stabilize supply and reduce surprises in price. The right structure depends on your risk tolerance and demand certainty, but the broader principle holds: committed demand is prioritized.

De-risk enterprise SSD programs by validating the full stack.

Treat SSD availability as a system outcome, not a NAND outcome. Validate controller availability, substrates, power loss protection components, and on-drive DRAM assumptions. Confirm that alternates are qualified or qualify them proactively. This is often where programs slip when teams focus only on NAND supply.

Segment your purchasing strategy by criticality.

Not every part deserves the same approach. For highly constrained or hard-to-replace parts, prioritize continuity and security of allocation. For more flexible items, staged buying tied to confirmed demand can manage working capital while reducing exposure to sudden price moves.

Budget with scenarios and triggers.

Instead of a single price assumption, build a range and define triggers for action. Pre-approve alternates and escalation paths so that procurement does not stall when quotes change quickly.

Closing perspective

This market is being reshaped by structural demand and disciplined supply behavior. The organizations that navigate it best will be those that plan earlier, qualify intelligently, and align procurement strategy to technology transitions.

Connect with our team today to learn how Arrow’s Intelligent Solutions can support your organization by translating market signals into practical allocation plans, qualification strategies, and sourcing structures that help protect schedules while managing cost and risk.